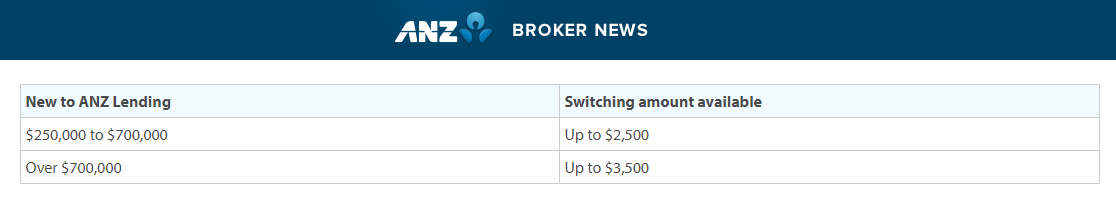

SWITCHING REBATE

Loan applications must be submitted by the 29 June 2019 and drawn by 30 September 2019.

Switching Amounts:

Eligibility Criteria:

- Effective for loans submitted on or after 29 October 2018.

- Available for new OFI (other financial institutions) refinanced ANZ Home and Residential Investment Loans with principal and interest repayments or interest only repayments.

- Available for ANZ Standard Variable, ANZ Fixed, ANZ Residential Investment and ANZ Simplicity PLUS products. This includes products held under an ANZ Breakfree Package or (where available) in a company name. Note: Line of Credit Accounts (Equity Manager) are not eligible.

- Customers must take out a minimum of $250k in new ANZ lending. There must be a refinance portion to the loan.

- Available to existing ANZ Home Loan or Residential Investment Loan customers refinancing an additional amount from another financial institution (total new lending must be at least $250k).

- Customers can only receive one switching repayment within a 12 month period.