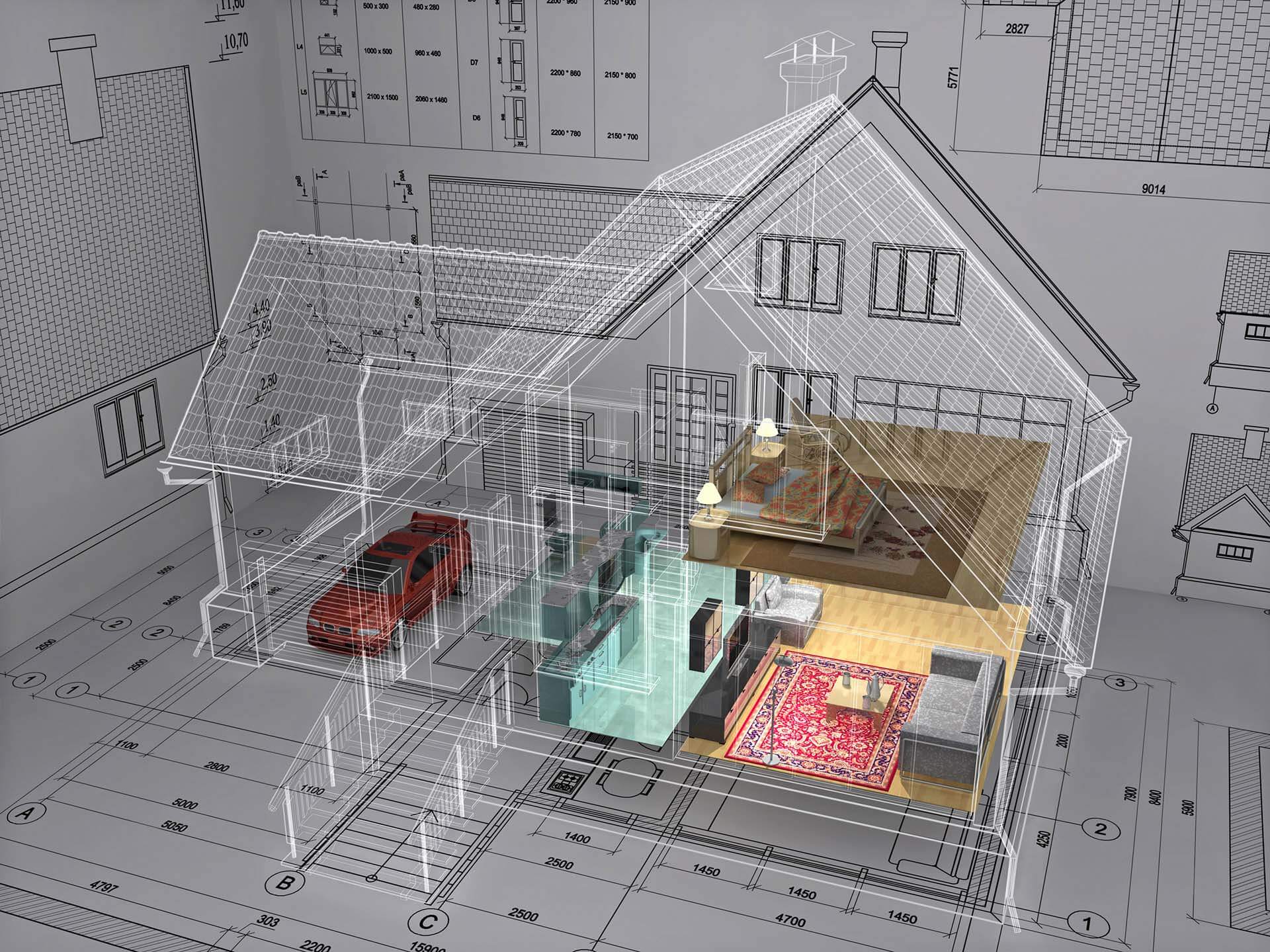

Should You Turn Your Home into an Investment Property?

January 4, 2019

Do you want to transform your home into an investment property? Well, this means that you need to take some factors into account. Is it the right decision to move from your house and turn it into an investment? Well, we’re here to help, so read on to find out more.

When is the right time to keep a property?

One of the biggest problems of owning multiple properties is the fact that your name is on the title, whether you lose or make money. So, you’re the only one responsible for those properties and if you make a mistake, you’ll be the one paying the costs. What could happen? Well, in the worst-case scenario, you could even lose your investments or your cash.

Also, keep in mind that if ownership costs are higher than rental income, then the asset is negatively affected and deducting the loss from the taxable income can cause problems. Usually, people don’t take negative gearing into consideration.

On the pro side, investors have the right to the income and appreciation in value, which is a good thing when the properties are giving a lot of money. However, everyone would want to own multiple properties if the deal had no risks.

Still, when investing for the long term, the good thing is that each month, you receive a direct cash flow.

When is the right time to sell a property?

Holding onto a property might not always be the best choice. It depends on both the owner’s financial situation and the property. For instance, some people are better off selling their first property and moving to the next one.

The borrowing ability is limited if you keep a mortgaged asset. However, you may stumble upon problems even if you pay your home loan. In the end, it is up to you to consider your goals and financial situation. So, you should examine every available option before selling the property.

Concluding Remarks

To sum up, it is up to you whether you turn your home into an investment property or not. Still, before making the decision, you should look at the advantages and disadvantages and decide wisely based on them.