Refinancing in 2026: Cashback Offers, Rates & What Borrowers Should Know

February 10, 2026

Refinance Cashback Offers in 2026: What Borrowers Should Know

With refinancing activity continuing into 2026, many Australian borrowers are reassessing their home loans to take advantage of cashback incentives, competitive interest rates, and improved loan structures—particularly where strong equity or multiple properties are involved.

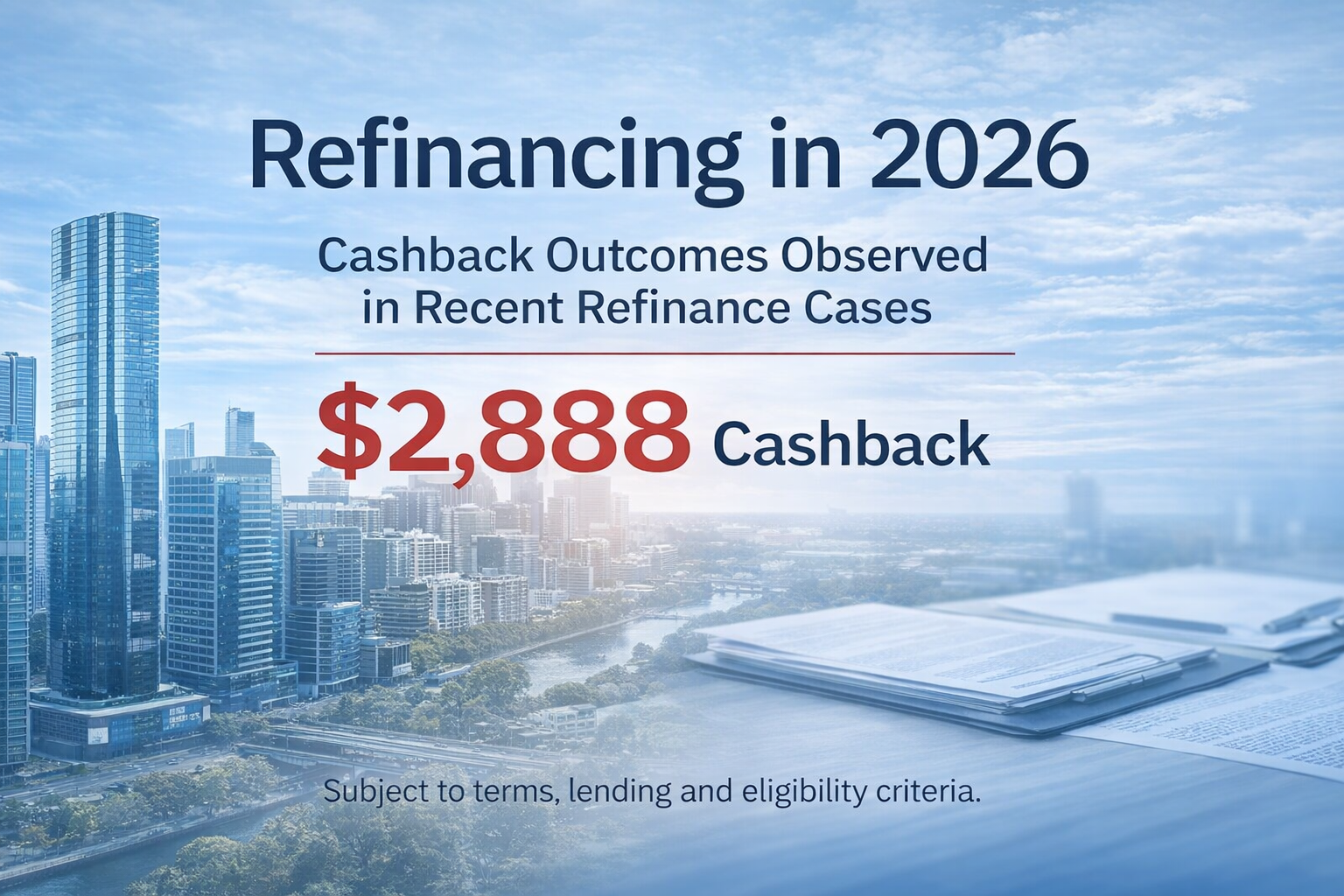

Current Refinance Cashback Offer

Eligible refinance applications with Bank of China (Australia) may qualify for a cashback of up to $2,888, provided:

-

Applications are submitted by 31 March 2026

-

Loans settle on or before 30 June 2026

-

Approval is subject to standard lending and credit criteria

Where applicable, borrowers with larger lending exposures may also receive a further 0.10% p.a. reduction on variable rates, helping reduce long-term interest costs.

Competitive Rates for Owner Occupied & Investment Loans

As at 2 February 2026, discounted variable rates are available across both Owner Occupied and Investment loans:

-

Owner Occupied (≤80% LVR):

Discount variable rates from 5.18% p.a., with offset options availableHome Loan Interest Rates Owner …

-

Investment loans (≤80% LVR):

Discount variable rates from 5.38% p.a., including Principal & Interest and Interest Only optionsHome Loan Interest Rates Invest…

Rates and availability are subject to lender policy and may vary based on LVR, loan type, and repayment structure.

Investment Property & Serviceability Considerations

For investment lending, lenders assess more than just rates. Common considerations include:

-

Maximum LVR limits, particularly for high-density apartments

-

Minimum internal floor area requirements (e.g. 50 sqm)

-

Rental income shading, with up to 70% of rental income typically used for serviceability

Loan affordability is assessed using lender serviceability calculators, factoring in income, liabilities, buffers, and proposed loan structures.

Why Strategic Advice Matters

Cashback offers and sharp rates can be appealing—but the right structure matters just as much. Whether refinancing a single home or a multi-property portfolio, professional advice helps ensure your loan aligns with policy, serviceability, and long-term goals, not just short-term incentives.

Rates and cashback offers are subject to change. Lending is subject to credit approval, eligibility criteria, and lender policies. Fees and conditions apply.