The February 2026 Business & Brokerage Roundup

Central Banks: The "Rates Shock" Continues In a move that has caught many off-guard, the Reserve Bank of Australia (RBA) released minutes today (February 17) from its recent meeting, signaling that interest rates—now at 3.85%—may need to climb as high as 4.45% by 2028 to curb stubborn inflation. The Broker Take: Mortgage brokers and commercial lenders should prepare for a "higher-for-longer" environment. While initial hopes for 2026 were for a cooling period, the focus has shifted back to debt serviceability and conservative financial planning for small business clients. The "Great Rotation": Tech Cools, Commodities Flame Up A major theme this week ...

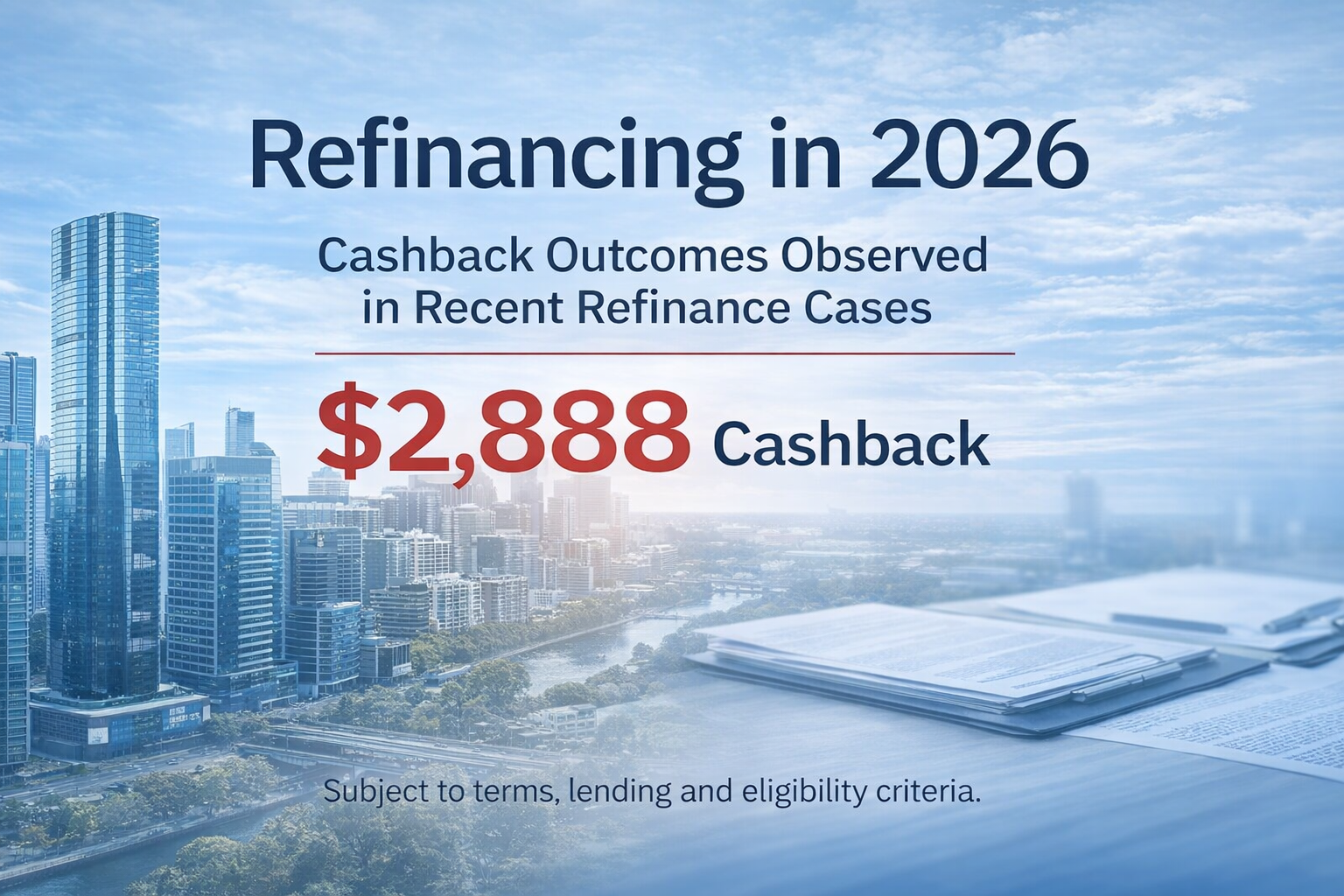

Refinancing in 2026: Cashback Offers, Rates & What Borrowers Should Know

Refinance Cashback Offers in 2026: What Borrowers Should Know With refinancing activity continuing into 2026, many Australian borrowers are reassessing their home loans to take advantage of cashback incentives, competitive interest rates, and improved loan structures—particularly where strong equity or multiple properties are involved. Current Refinance Cashback Offer Eligible refinance applications with Bank of China (Australia) may qualify for a cashback of up to $2,888, provided: Applications are submitted by 31 March 2026 Loans settle on or before 30 June 2026 Approval is subject to standard lending and credit criteria Where applicable, borrowers with larger lending exposures may also receive a ...

Market Outlook: The “Soft Landing” Under Stress

The RBA’s move to 3.85% marks the first upward shift in the cash rate since late 2023, signaling a hawkish turn that caught some financial markets off guard. In her statement following the February 3 board meeting, RBA Governor Michele Bullock noted that while inflation has retreated from its 2022 peaks, it "picked up materially in the second half of 2025," driven by resilient private demand and a tight labor market. Economists are now divided on the trajectory for the remainder of 2026. While CBA and Westpac analysts suggest the RBA may hold steady for the next quarter to observe the ...

RBA Rate Hikes, High-Conviction Suburbs, and the Dawn of the DTI Guardrail Era

Rate Hikes Return in 2026 After a year of easing in 2025, the Reserve Bank of Australia surprised markets by lifting the cash rate on 3 February 2026, marking its first hike in more than two years. Inflation Back in Focus: Early-year inflation proved more persistent than forecast, prompting the RBA to reverse course and reassert its inflation-fighting stance. What This Means for Brokers: All four major banks have already moved to lift fixed mortgage rates. This opens a short but critical window for brokers to proactively review client loan structures, challenge “lender loyalty,” and secure more resilient setups ahead of ...

Markets Eye RBA’s First Policy Decision of 2026

As the Reserve Bank of Australia’s (RBA) first policy meeting of 2026 approaches, financial markets are increasingly focused on what the central bank’s next move on monetary policy may be. The RBA lowered interest rates three times throughout 2025, bringing the official cash rate down to 3.6%. This easing cycle offered welcome relief to mortgage holders and property investors who have been grappling with high living costs and persistently strong property prices. However, recent signs of rising inflation combined with a tight labour market have dampened expectations for further rate cuts in the short term. As a result, some market participants ...

“I’ve failed over and over again in my life. And that is why I succeed.

“I’ve failed over and over again in my life. And that is why I succeed.

Arcu auctor gravida nisl, congue sit nisi tincidunt eget proin. In lacinia lacus donec sed massa in ipsum eros, tristique. Gravida suspendisse etiam in iaculis